Cryptocurrency has emerged as a transformative force in the world of finance and technology. It is a digital or virtual form of currency that utilizes cryptography for secure financial passage, control the creation of new units, and verify the transfer of assets.

Since the introduction of Bitcoin in 2009, the first decentralized cryptocurrency, the landscape of digital currencies has expanded significantly. This article provides a comprehensive overview of cryptocurrency, exploring its history, underlying technology, types of crypto, benefits, drawbacks, and its impact on the global economy

Additionally, it delves into the role of blockchain technology, the future trends, and the challenges facing the widespread adoption of crypto. However if you want to start mining bitcoin visit Aiprofit.us is legit and reliable

Introduction to Cryptocurrency

What is Cryptocurrency?

Cryptocurrency. It sounds like a word straight out of a sci-fi movie, right? Well, it kind of is. But don’t worry, it’s not as complex as it sounds. At its core, cryptocurrency is a digital or virtual form of money that uses cryptography for secure transactions and control of additional units. In simpler terms, it’s like digital cash that exists solely in the digital realm.

Brief History of Cryptocurrency

The history of cryptocurrency may not be as long as the history of traditional forms of money, but it’s certainly fascinating. It all started with Bitcoin, which was created in 2009 by an elusive person (or group) known as Satoshi Nakamoto. Bitcoin was the first decentralized cryptocurrency, meaning it didn’t rely on any central authority like banks or governments.Since then, the world of cryptocurrency has exploded, with thousands of different cryptocurrencies being created. Some of them are serious projects, while others have questionable intentions. But one thing is for sure, cryptocurrency has become a global phenomenon, capturing the attention of investors, tech enthusiasts, and even your grandma who’s trying to figure out how to buy Bitcoin.

History and Evolution of Cryptocurrency

Early Beginnings of Cryptocurrency

Believe it or not, the idea of digital currency wasn’t entirely new when Bitcoin came along. There were previous attempts at creating digital money, but they never really took off. Bitcoin, however, gained traction and became the pioneer in the world of cryptocurrencies.

Major Milestones in Cryptocurrency Development

Since the birth of Bitcoin, numerous milestones have shaped the cryptocurrency landscape. From the explosion of altcoins (alternative cryptocurrencies) to the rise of blockchain technology, the industry has experienced rapid growth and unprecedented developments. Cryptocurrency exchanges, initial coin offerings (ICOs), and regulatory challenges have also played a significant role in shaping the evolution of this digital phenomenon.

How Cryptocurrency Works

Blockchain Technology

At the heart of every cryptocurrency lies blockchain technology. Think of it as a digital ledger that records all transactions across a network of computers. This decentralized and transparent system ensures the security and integrity of transactions, making it virtually impossible to tamper with or manipulate the data.

Cryptographic Principles

Cryptocurrencies use advanced cryptographic techniques to secure transactions and control the creation of new units. This involves complex mathematical algorithms that prevent fraud and protect the privacy of users.

Decentralization and Peer-to-Peer Networks

Unlike traditional financial systems that rely on central authorities, cryptocurrencies operate on a peer-to-peer network. This means that transactions occur directly between individuals without the need for intermediaries. Decentralization is a core principle of cryptocurrencies, giving users control over their own funds and eliminating the need for trust in third parties.

Types of Cryptocurrencies

Bitcoin (BTC)

Bitcoin is the OG of cryptocurrencies. It paved the way for the entire industry and is often used as a benchmark for other digital currencies. Bitcoin operates on the principles we discussed earlier, offering a decentralized and secure form of digital cash.

Ethereum (ETH)

Ethereum is more than just a cryptocurrency; it’s a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It introduced the concept of programmable blockchain, revolutionizing the possibilities of what can be built on a blockchain.

Ripple (XRP)

Ripple aims to facilitate fast, low-cost international money transfers. Unlike most cryptocurrencies, Ripple works closely with traditional financial institutions, providing them with a blockchain-based settlement system. Its token, XRP, serves as a bridge currency for cross-border transactions.

Other Prominent Cryptocurrencies

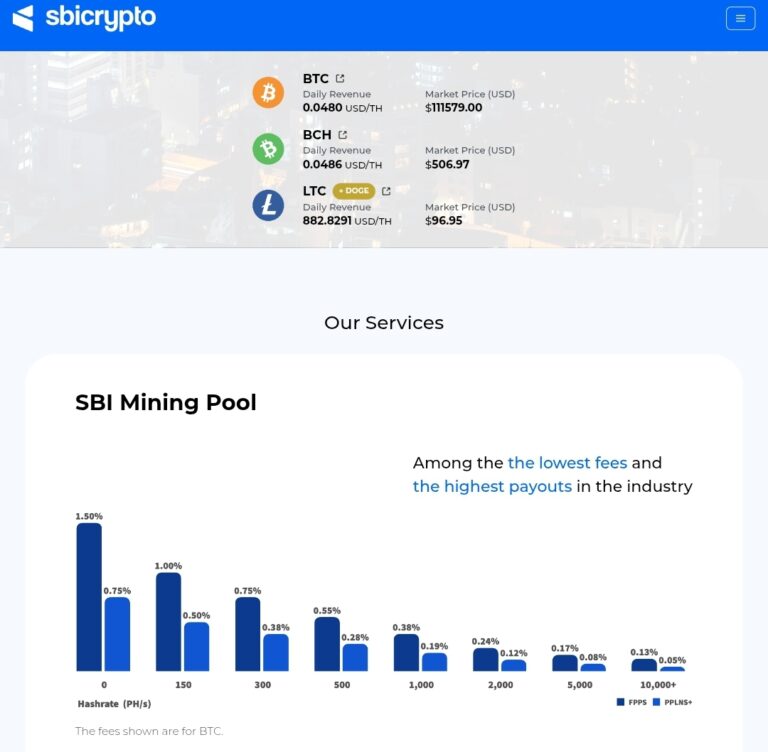

There are thousands of cryptocurrencies out there, each with its own unique features and use cases. Some other notable cryptocurrencies include Litecoin (LTC), Bitcoin Cash (BCH), and Cardano (ADA). Each of these coins brings its own flavors to the table and continues to shape the ever-evolving landscape of the crypto world.Now that you have a basic understanding of cryptocurrency, it’s time to dive deeper into this exciting and sometimes perplexing digital universe. So strap on your crypto helmets and get ready to explore the fascinating world of digital money!

Benefits and Drawbacks of Cryptocurrency

Advantages of Cryptocurrency

Cryptocurrency, like Bitcoin, offers several benefits that have contributed to its popularity among investors and enthusiasts. Here are some advantages of using cryptocurrency:1. Decentralization: Unlike traditional currencies controlled by central banks, cryptocurrency operates on a decentralized network. This means that transactions are not governed by any single authority, providing users with greater control over their funds.2. Security: Cryptocurrency uses advanced encryption techniques to secure transactions and control the creation of new units. This makes it highly resistant to fraud and hacking, ensuring the safety of user funds.3. Fast and Borderless Transactions: Cryptocurrency allows for quick and seamless transactions across borders, bypassing the need for intermediaries like banks. This eliminates delays and reduces costs associated with cross-border transfers.4. Lower Transaction Fees: Cryptocurrency transactions typically have lower fees compared to traditional payment methods. This makes it an attractive option for businesses and individuals, especially when dealing with international transactions.

Financial Inclusion:

Cryptocurrency has the potential to provide financial services to the unbanked population in developing countries. Since it operates on a digital platform, access to cryptocurrency is not limited by physical infrastructure, opening up opportunities for those who lack access to traditional banking services.

Potential Drawbacks and Risks

While cryptocurrency offers several advantages, it also comes with its fair share of drawbacks and risks. Here are a few potential concerns:1. Volatility: Cryptocurrency markets are highly volatile, with prices experiencing significant fluctuations. This volatility can impact the value of investments and make it challenging to predict market trends accurately.

Regulatory Uncertainty: The regulatory environment surrounding cryptocurrency is still evolving, with different countries implementing varying degrees of regulation. This lack of clarity can create uncertainty for investors and inhibit widespread adoption.

Security Risks: While cryptocurrency itself is secure, the infrastructure supporting it, such as exchanges and digital wallets, can be vulnerable to hacking and cyber attacks. It is crucial for users to take necessary precautions to protect their digital assets.

Limited Acceptance: Although the acceptance of cryptocurrency has increased in recent years, it is still not widely accepted as a form of payment. This limited acceptance can restrict the practicality and everyday usability of these digital currencies.5. Irreversible Transactions: Once a cryptocurrency transaction is completed, it is usually irreversible. Unlike traditional banking systems, where chargebacks and refunds are possible, cryptocurrency transactions are permanent. This feature can be a disadvantage if errors occur or fraudulent transactions take place.

The Role of Blockchain in Cryptocurrency

Blockchain Technology Explained

At the heart of cryptocurrency is blockchain technology. Put simply, a blockchain is a decentralized digital ledger that records and verifies transactions across multiple computers. Here’s how it works:1. Distributed Ledger: Blockchain operates as a distributed ledger, meaning that all participants in the network have access to the same information. This transparency and immutability ensure that transactions cannot be altered or tampered with.2. Consensus Mechanism: Blockchain relies on a consensus mechanism to validate and confirm transactions. This mechanism ensures that all participants agree on the accuracy of the transaction, preventing double-spending and fraud.3. Blocks and Chains: Transactions are grouped into blocks, which are then added to the chain in a chronological order. Each block contains a unique identifier (hash) and the hash of the previous block, creating a secure and tamper-resistant chain of transaction records.

How Blockchain Secures Cryptocurrency Transactions

Blockchain technology enhances the security and integrity of cryptocurrency transactions in several ways:1. Decentralization: Blockchain eliminates the need for a central authority to oversee transactions, making it resistant to censorship and single points of failure.

Encryption: Transactions recorded on the blockchain are encrypted, making it extremely difficult for unauthorized parties to access or alter the data.3. Immutability: Once a transaction is recorded on the blockchain, it becomes nearly impossible to change or delete. This ensures the integrity and irrefutability of transaction history.4. Verification Through Consensus: The consensus mechanism in blockchain requires multiple participants to validate and agree on the accuracy of transactions, preventing fraudulent or malicious activities.5. Reducing Counterparty Risk: Cryptocurrency transactions conducted through blockchain eliminate the need for intermediaries, reducing counterparty risk and increasing trust between transacting parties.

Cryptocurrency in the Global Economy

Cryptocurrency Adoption and Regulation

The adoption and regulation of cryptocurrency vary across different countries and regions. While some governments embrace digital currencies and blockchain technology, others are more cautious. Here are a few key points regarding cryptocurrency in the global economy:1. Regulatory Approaches: Regulatory frameworks for cryptocurrency range from strict regulations to more crypto-friendly environments. Some countries have implemented licensing requirements for exchanges and strict reporting obligations, while others have taken a more hands-off approach, allowing market forces to drive adoption.2. Government-Backed Digital Currencies: Several countries, including China and Sweden, are exploring the concept of central bank digital currencies (CBDCs). These government-backed digital currencies aim to complement or replace traditional fiat currencies and streamline financial transactions.3. International Cooperation: International organizations, such as the G20 and the Financial Action Task Force (FATF), are working towards creating standardized regulations and guidelines to combat money laundering, terrorist financing, and other risks associated with cryptocurrency.

Impact of Cryptocurrency on Financial Systems

Cryptocurrency has the potential to disrupt traditional financial systems in several ways:1. Financial Inclusion: Cryptocurrency can provide financial services to the unbanked and underbanked populations, allowing them to access financial tools and services without relying on traditional banking infrastructure.2. Cross-Border Transactions: Cryptocurrency facilitates faster and cheaper cross-border transactions, eliminating the need for intermediaries and reducing transaction costs. This can have a significant impact on remittance payments and international trade.3. Innovation and Competition: As cryptocurrency gains mainstream adoption, it encourages innovation in financial services. Traditional financial institutions are exploring ways to incorporate blockchain technology to improve efficiency, security, and cost-effectiveness.

Future Trends and Challenges of Cryptocurrency

Emerging Technologies and Innovations

The future of cryptocurrency holds several exciting possibilities, driven by emerging technologies and innovations. Here are a few potential trends to watch out for:1. Scalability Solutions: Scalability remains a significant challenge for cryptocurrencies like Bitcoin, with limitations on transaction throughput. Solutions like layer-two protocols (e.g., Lightning Network) and sharding aim to increase transaction capacity and speed.

Interoperability: As the number of cryptocurrencies and blockchain networks grows, the need for interoperability between different systems becomes crucial. Projects like Polkadot and Cosmos aim to facilitate seamless communication and data transfer between various blockchains.

Central Bank Digital Currencies: The adoption of government-backed digital currencies, also known as central bank digital currencies (CBDCs), is expected to increase. These digital currencies will coexist with cryptocurrencies while providing greater control and oversight for governments.

Regulatory and Legal ChallengesIn conclusion, cryptocurrency has revolutionized the way we perceive and interact with money. Its decentralized nature, built on blockchain technology, offers immense potential for secure, transparent, and efficient financial transactions. While cryptocurrencies have gained popularity and acceptance, they also face challenges such as regulatory concerns and scalability issues. As the landscape continues to evolve, it is crucial to stay informed about the latest trends and developments in this dynamic industry. Cryptocurrency holds the promise of reshaping our global economy, and its future potential is something that cannot be ignored.

FAQ

What is the purpose of cryptocurrency?

Cryptocurrency serves as a digital form of currency that aims to provide secure, decentralized, and transparent financial transactions. It enables individuals to send and receive funds globally without the need for intermediaries like banks, reducing transaction fees and enhancing financial inclusivity.

Are all cryptocurrencies the same

No, there are various types of cryptocurrencies, each with its unique features and purposes. Bitcoin, the pioneering cryptocurrency, introduced the concept of digital currency, while others like Ethereum focus on smart contracts and decentralized applications (DApps). Different cryptocurrencies cater to different needs and industries.

How secure are cryptocurrencies?

Cryptocurrencies use advanced cryptographic techniques to secure transactions and wallets. The underlying blockchain technology ensures transparency and prevents tampering. However, while the technology is secure, individuals must also take responsibility for securing their private keys and using reputable wallets and exchanges to mitigate potential risks.

How is cryptocurrency regulated?

Regulation of cryptocurrencies varies across different countries and regions. Some nations have embraced cryptocurrencies and adopted regulatory frameworks to ensure consumer protection, prevent fraud, and address money laundering concerns. However, the regulatory landscape is still evolving, and there is no standardized approach globally. It is advisable to stay informed about the regulations in your jurisdiction when dealing with cryptocurrencies. Read our review on crypto mining